- Forex Calculators 4. Advanced Camarilla; Advanced Elliott Wave; Advanced Gann Square of Nine; Simple Gann Square of Nine; Gann Calculators 4. Forex Gann Square of 9; Simple Gann Square of 9; Advanced Gann Square of 9; Gann Positional/Swing; Pivot Points 2. Simple Pivot Point; Fibonacci Pivot Point; Camarilla Calculation; Advanced.

- The Advanced Camarilla Equation in calculates twelve levels of Intraday Support and Resistance. THE FINANCIAL DOCTORS: Advanced Camarilla Trading Calculator.

- Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using.

You have probably heard about the 'Camarilla Equation' by now, and how Day Trading is made easier by it - allegedly a secret day trading formula that will help your day trading reach new heights of accomplishment, with the bare minimum of risk. Or so the story goes. But what about the reality? We have investigated the Camarilla Equation thoroughly, and can now report on the truth behind this amazing phenomenon.The first thing you should realise is that there are a number of different versions out there all confusingly called 'Camarilla'. Most are attempts by amateur traders on notice boards and such like to 'crack the secret' of the Equation, which are obviously worth what you pay for them (nothing!) and there are a few commercial websites offering a 'Camarilla Equation' all appearing to be based on different ideas and mathematics. The version we have had success with is the 'SureFireThing Camarilla Equation', discovered in 1989 by a semi-legendary bond trader called Nick Scott which is the only offering that has convinced us that the Equation works, and the only site that can offer any kind of explanation behind the phenomenon.

You have probably heard about the 'Camarilla Equation' by now, and how Day Trading is made easier by it - allegedly a secret day trading formula that will help your day trading reach new heights of accomplishment, with the bare minimum of risk. Or so the story goes. But what about the reality? We have investigated the Camarilla Equation thoroughly, and can now report on the truth behind this amazing phenomenon.The first thing you should realise is that there are a number of different versions out there all confusingly called 'Camarilla'. Most are attempts by amateur traders on notice boards and such like to 'crack the secret' of the Equation, which are obviously worth what you pay for them (nothing!) and there are a few commercial websites offering a 'Camarilla Equation' all appearing to be based on different ideas and mathematics. The version we have had success with is the 'SureFireThing Camarilla Equation', discovered in 1989 by a semi-legendary bond trader called Nick Scott which is the only offering that has convinced us that the Equation works, and the only site that can offer any kind of explanation behind the phenomenon. camarilla. cam·a·ril·la. A group of confidential, often scheming advisers; a cabal.[Spanish, diminutive of cámara, room, from Late Latin camera. See chamber.]

What is Camarilla Calculator? This formula was introduced in 1989 by a UK bond trader named Nick Stott. The Camarilla Equation in calculates ten levels of intra-day support and resistance according to yesterday’s High, Low, Open and Close. There are 5 of these “S” levels below yesterday’s close, and 5 “R” levels above. The formula used in the calculation of Camarilla Pivot Points are: R4 = C + RANGE. 1.1/2 R3 = C + RANGE. 1.1/4 R2 = C + RANGE. 1.1/6 R1 = C + RANGE. 1.1/12. The word 'Camarilla' is based on the Latin word for room (camera), and it means basically a small clique of 'advisers' who try to manipulate the person in power for their own ends.

Discovered while day trading in 1989 by Nick Scott, a successful bond trader in the financial markets, the SureFireThing 'Camarilla' equation uses a truism of nature to define market action - namely that most time series have a tendency to revert to the mean. In other words, when markets have a wide spread between the high and low the day before, they tend to reverse and retreat back towards the previous day's close. The SureFireThing Camarilla Equation uses some complicated mathematics to pluck 8 levels out of thin air, using nothing more than yesterday's open, high, low and close. These levels are, frankly, astounding in their accuracy as regards day trading, even to seasoned traders, who know all about support and resistance, pivot points and so on. SureFireThing.com supply their online SFT Camarilla Equation calculator for day trading at probably the lowest cost available anywhere. There are a number of other commercial sites purporting to supply a 'Camarilla' equation, but we cannot vouch for any of them, as none would give us a free trial! There are also various free websites offering 'Camarilla' Equation calculations, usually based on fairly standard pivot points and so on. None of these produces the same results as the SureFireThing version, and trading with them must therefore be regarded as 'pot luck'.

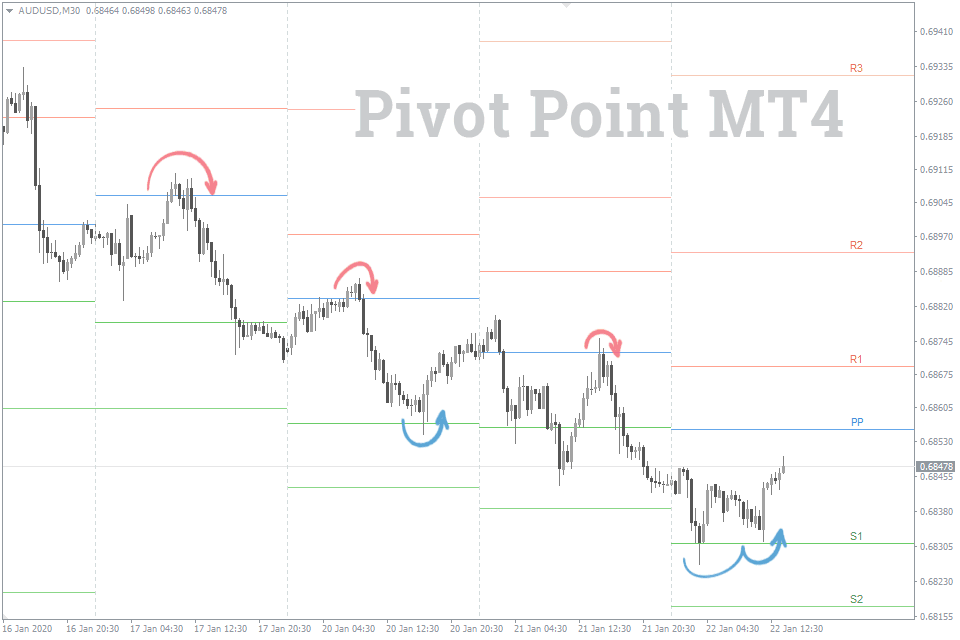

The SFT Camarilla Equation produces 8 levels from yesterday's open, high, low and close. These levels are split into two groups, numbered 1 to 4. The pattern formed by the 8 levels is broadly symmetrical, and the most important levels are the 'L3', 'L4' and 'H3', 'H4' levels. While day trading, traders look for the market to reverse if it hits an 'L3' or 'H3' level. They would then open a position AGAINST the trend, using a stop loss somewhere before the associated 'L4' or 'H4' level. The SFT theory suggests setting stoplosses that appear to you the trader to be prudent, and to not even open the trade until it has penetrated the level in the 'right' direction, i.e. demonstrated that it has found resistance (or support). In the case of the higher H3 level, this would mean that price had already reversed and pushed back down thru the level, heading south.

The second way to try day trading with the Camarilla Equation is to regard the 'H4' and 'L4' levels as 'breakout' levels - in other words to go WITH the trend if prices push thru either the H4 or L4 level. This essentially covers all the bases - Day Trading within the H3 and L3 levels enables you to capture all the wrinkles that intraday market movement throws up, and the H4 - L4 breakout plays allow the less experienced trader to capitalise on relatively low risk sharp powerful movements. Here's what it looks like in action:-

Interestingly enough, SureFireThing.com supply 2 versions of the calculator for day trading enthusiasts, their 'original' version, to be used by experienced day traders who enjoy the cut and thrust of the day's action, and a '{b}' version, for the less experienced day traders. This {b} version exploits the day trading breakout potential of the SFT Camarilla Equation, and furthermore, provides suggested stoplosses and profit targets that allow a beginner to rapidly get up to speed (and start making money, hopefully!) until such time as they are confident of trying the 'original' equation.

If you want to jump right in and try it, the best place to look is Day Trading Site , as they have a professional, fast website, and reasonable charges. I can make no comments about any other websites offering 'camarilla equations' as I'm STILL waiting for a free trial. The supposed 'camarilla' formulas to be found on various trading boards etc have turned out to be rather unusable attempts to capture the maths in a simplistic fashion, so those aren't recommended either. If you want more information about Day Trading in general, we would recommend www.traders101.com

(C) Camarilla Equation.com 1996 - 2014

Camarilla equation gives eight levels of intraday support from yesterday's high, low and close. There are 4 of these 'H' levels below yesterday's close, and 4 'L' levels above. They are numbered as H1, H2, H3, H4, L1, L2, L3, L4. The most important levels in the advanced Camarilla intraday trading are H3, L3, H4, L4 levels.

Camarilla Intraday Trading Equation

Camarilla equation gives eight levels of intraday support from yesterday's high, low and close. There are 4 of these 'H' levels below yesterday's close, and 4 'L' levels above. They are numbered as H1, H2, H3, H4, L1, L2, L3, L4. The most important levels in the advanced Camarilla intraday trading are H3, L3, H4, L4 levels.

Formula:

H4 = (0.55 * (h - l)) + cH3 = (0.275 * (h - l)) + cH2 = (0.183 * (h - l)) + cH1 = (0.0916 * (h - l)) + cL1 = c - (0.0916 * (h - l))L2 = c - (0.183 * (h - l))L3 = c - (0.275 * (h - l))L4 = c - (0.55 * (h - l))Where,h = Previous Day Highl = Previous Day Lowc = Previous Day CloseCalculation of Camarilla Intraday Trading is made easier here.

Related Calculators:

Camarilla Advanced Calculator Formula Sheet

Top Calculators

How To Use Advanced Camarilla Calculator